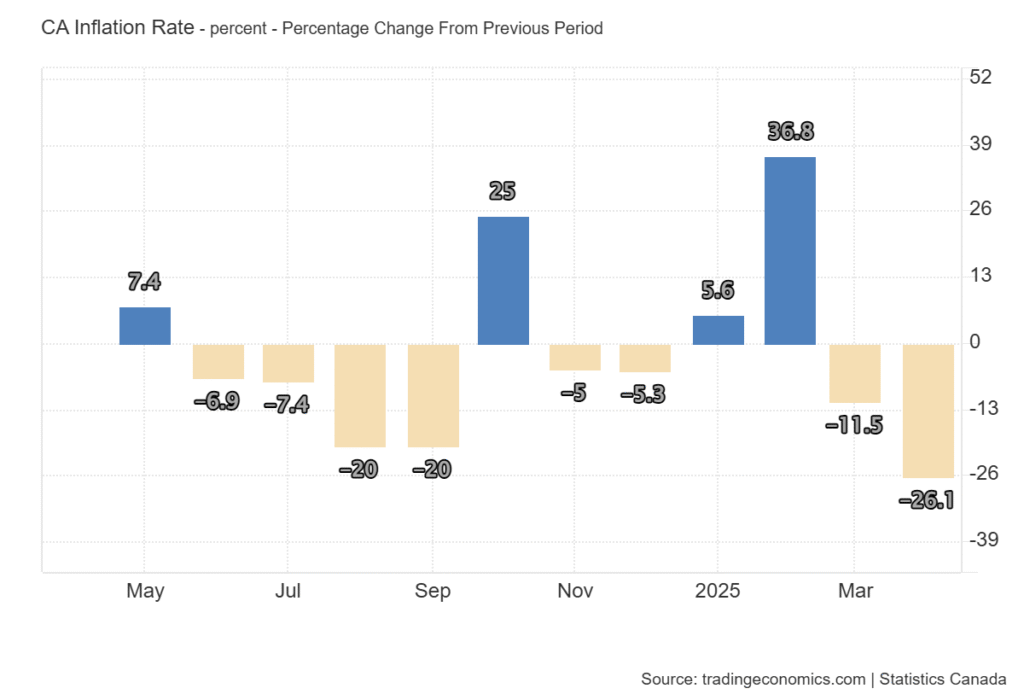

Vancouver, BC – May 2025 — Canada’s annual inflation rate slowed sharply to 1.7% in April, down from 2.3% in March, marking the softest rise in consumer prices in seven months, according to the latest Statistics Canada data. While slightly above expectations (1.6%), the pullback in inflation is largely attributed to declining energy prices, amplified by both OPEC output increases and the recent removal of the consumer carbon tax.

With gasoline prices plunging 18.1% and natural gas costs dropping 14.1%, the transportation sector saw an overall price decline of 1.9%, offering welcome relief to consumers.

📉 Core CPI Stirs BoC Caution

Despite the broader disinflationary trend, the trimmed-mean core CPI—the Bank of Canada’s preferred gauge of underlying inflation—rose unexpectedly to 3.1%. This figure remains above the BoC’s 2% target and signals that underlying price pressures persist, especially in sectors like groceries (3.8%), travel (6.7%), and recreation (1.4%).

This divergence complicates the Bank of Canada’s interest rate decision for June. While headline inflation supports a case for rate cuts, the uptick in core CPI may encourage a more cautious, data-dependent approach.

🏠 Impact on Vancouver’s Housing Market

For the Vancouver real estate market, this inflation report brings mixed signals:

✅ Potential Rate Cut Momentum

- Falling headline inflation strengthens the case for lower interest rates—a scenario that would ease mortgage borrowing costs.

- If the BoC cuts its overnight rate in June or July, we could see a resurgence of buyer interest, particularly in entry-level and investor-friendly segments like condos and townhomes.

⚠️ Caution from Rising Core Inflation

- The unexpected rise in core inflation may delay or reduce the magnitude of future rate cuts.

- Lenders may remain conservative in adjusting mortgage rates until sustained disinflation is confirmed, keeping financing conditions relatively tight in the short term.

📊 Market Sentiment Shift

- Buyer and seller psychology is highly sensitive to rate expectations. Even the prospect of future rate relief can spur renewed market activity.

- In Vancouver, where affordability is already stretched, any drop in monthly mortgage payments could significantly impact first-time buyer demand and investment property sales.

📍 Local Snapshot

Vancouver’s real estate market has already seen price corrections and muted sales activity due to high rates and economic uncertainty. A shift in monetary policy, combined with falling inflation and easing energy costs, could rebalance the market in the second half of 2025—especially if macroeconomic volatility stabilizes.

While April’s inflation data paints a more optimistic picture for Canadian households, all eyes remain on the Bank of Canada’s June decision. For Vancouver real estate, the potential for interest rate cuts may serve as the catalyst for a moderate rebound in housing activity, especially in a market that’s been subdued for most of the past year.

As always, buyers and sellers should stay informed and work closely with real estate professionals to make the most of market opportunities in this evolving environment.